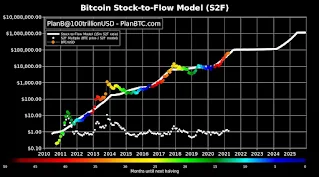

Cryptocurrency forcast for $100k

Bitcoin, the world's first cryptocurrency, has been on a rollercoaster ride since its inception in 2009. In the last few years, it has gained significant attention from investors, traders, and individuals looking to diversify their investment portfolios. As of March 2023, Bitcoin's price is hovering around $60,000, up from a low of around $3,000 in March 2020. While Bitcoin's price has seen tremendous growth in recent years, the question on many people's minds is whether Bitcoin's price can reach $100,000. In this article, we will explore the chances and circumstances that could lead to a Bitcoin price of $100,000. pi cryptocurrency price, ankr crypto, best crypto trading platform, cosmos crypto, best crypto to buy now, cryptocurrency trading, crypto apps, apt crypto are some exmaple for future trades.

Bitcoin's market cap is currently around $1.2 trillion, making it the largest cryptocurrency by market capitalization. While Bitcoin's market cap is still relatively small compared to traditional assets like gold or stocks, it has grown significantly in the last few years. Some analysts believe that Bitcoin's market cap could eventually surpass that of gold, which is currently valued at around $10 trillion. If Bitcoin were to reach that level, it would translate to a price of around $500,000 per Bitcoin.

However, the question remains: can Bitcoin reach $100,000? The answer to this question is not straightforward, as there are several factors that could influence Bitcoin's price in either direction.

One factor that could contribute to a $100,000 Bitcoin price is increased institutional adoption. Over the last few years, we have seen a growing number of institutions, including banks and hedge funds, investing in Bitcoin. These institutional investors have helped to increase demand for Bitcoin and provide legitimacy to the cryptocurrency. If more institutions continue to adopt Bitcoin as an asset class, it could lead to increased demand and a higher price.

Another factor that could contribute to a $100,000 Bitcoin price is increased adoption among retail investors. While Bitcoin has gained significant attention in recent years, it is still not widely adopted by the general public. As more people become aware of Bitcoin's potential and begin to invest in it, the price could increase significantly.

Regulatory changes could also impact Bitcoin's price. In recent years, we have seen several countries, including China and India, ban or restrict the use of cryptocurrencies. If more countries were to follow suit, it could have a negative impact on Bitcoin's price. However, if more countries were to embrace cryptocurrencies and provide a clear regulatory framework for them, it could lead to increased adoption and a higher price.

Lastly, the overall economic environment could impact Bitcoin's price. Bitcoin has often been seen as a hedge against inflation and economic uncertainty. If the global economy experiences a downturn or there is significant inflation, it could lead to increased demand for Bitcoin and a higher price.

In conclusion, while there are several factors that could contribute to a $100,000 Bitcoin price, it is impossible to predict with certainty whether or not it will happen. However, as Bitcoin continues to gain mainstream adoption and more investors enter the market, the chances of a higher price increase. As always, it is important to approach investing in Bitcoin with caution and to do your own research before making any investment decisions.